November 2021 - Luke's Global Fund Performance Update

- Sean Rapley

- Dec 8, 2021

- 3 min read

Updated: Jan 20, 2022

Luke's Global Fund achieved a return of -17.3% (in constant currency) return over the month of November, and a 18.6% gain to date for FY22 on a constant currency basis. Our International Benchmark, the S & P 500, returned -0.8% for the month of November, and the benchmark returned 6.2% to date this financial year.

Our portfolio as at November 31, 2021 is outlined in Figure 1 below:

Figure 1 - Portfolio Pie Chart

TOP CONTRIBUTORS

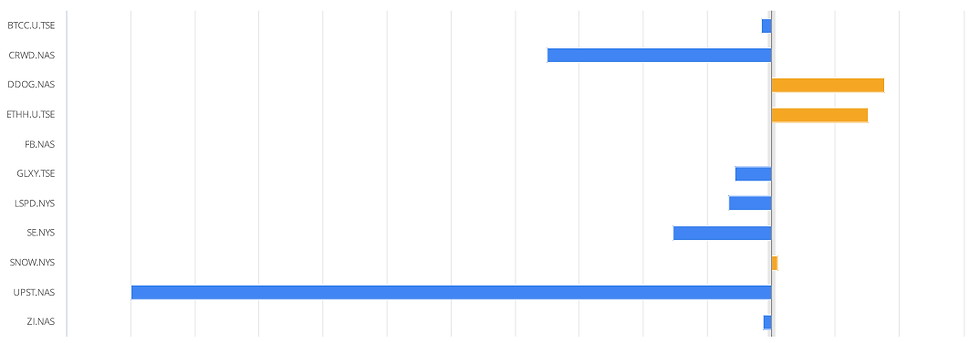

Our contribution analysis for the month of November is outlined in Figure 2 below:

Figure 2 - Contribution Analysis Bar Chart

The portfolio performance for November was significantly impacted by the largest position in our portfolio, Upstart Inc. Upstart was sold off heavily, following its Q3 results, after the market was seemingly disappointed with what we considered a good result, and amid growing concerns about the lending environment going forward.

TRADING ACTIVITY

During the month of November, we sold out of our Lightspeed Inc. position, following a disappointing quarterly result, with a noticeable deceleration in revenue, and customer sign ups.

We added to our Ethereum exposure, and opened a position in Galaxy Digital Holdings Ltd.

We note, that if there is a transition from an inflationary to deflationary environment over the coming months, we will need to close / reduce our Ethereum and Bitcoin exposure. Should the US Federal Reserve continue to accelerate QE tapering, there is a possibility growth and inflation will slow significantly by mid 2022.

COMPANY NEWS & REPORTS

November the following companies reported:

Zoominfo

Zoominfo reported Q3 results on November 1, 2021, with the following key takeaways:

Revenue of $197.6 million, up 14% on prior quarter.

GAAP operating income margin of 10%.

Closed the quarter with 1250 customers worth +$100k in annualised contact value, up from 1100 in the prior quarter.

Datadog

Datadog reported Q3 results on November 4, 2021, with the following key takeaways:

Revenue growth accelerated, up 15% on the prior quarter, to $270.5 million.

1800 customers now with +$100 k annual recurring revenue, up 66% over the prior corresponding period.

10 new products and features launched over the quarter.

Upstart

Upstart reported Q3 results on November 9, 2021, with the key takeaways:

Total revenue of $228 million, up 18% on the prior quarter.

GAAP Income was $29.1 million, up 200% over the prior corresponding period.

Bank Partner originated loans of 362780, totalling $3.13 billion, up 244% on prior corresponding period.

Conversion rate fell slightly to 23% this quarter.

Q4 guidance for 16% revenue growth (allowing for the usual sandbagging, guiding for an acceleration in revenue growth).

Sea Ltd

Sea Ltd reported result on November 16, 2021, with the following key takeaways:

Total GAAP Revenue was $2.7 Billion, up 121.8% year-on-year.

Gross margins fell from 41% to 36% over the quarter, as the E-commerce portion of revenue increases.

Digital Entertainment division revenue grew 10% over the quarter, as quarterly active users reached 729 million, which was up 0.5% for the quarter. Average bookings per user increased 5% over the quarter.

E-commerce GAAP revenue grew 160.7% over the prior corresponding period. However, losses increased, EBITDA loss of $579.8 million , up from $313.3 million on prior corresponding period. Shopee app ranked first in Brazil, Indonesia, and Taiwan.

KEY LEARNINGS THIS MONTH:

One can just accept volatility as the price of pursuing high returns, or one can seek to mitigate the volatility and adjust portfolio exposure according to the prevailing macro environment. To date, our portfolio has adopted the former strategy. However, as the portfolio size has become relatively significant, preserving wealth and reducing volatility is becoming an increasingly important consideration.

November has been a volatile month for the portfolio, as market sentiment switched from reflationary to inflationary, resulting in significant valuation compression for growth stocks over the month. A case in point is Crowdstrike, and Figure 3 below shows Crowdstrike’s EV/S ratio over the past 11 quarters, overlaid with 42 Macro’s Macro Regime. Figure 3 shows Crowdstrike's EV/S ratio generally compresses during periods of low growth (red / blue).

We believe the volatility experienced in November is a sign of things to some, with leading indicators pointing towards the increasing probability of a deflationary environment from around Q2 2022 and beyond. Currently, our portfolio has no exposure to assets that outperform in deflationary environments, and we will, somewhat belatedly, address this in December. We will also engage a macro quantitative analyst to incorporate macro risks into our portfolio settings. We will include a macro specific section in future monthly updates.

If you have any opinions on the companies we hold, or would like to know more about our investments, we would love to hear your feedback.

Regards,

Sean

Comments